Examine This Report on Kam Financial & Realty, Inc.

Examine This Report on Kam Financial & Realty, Inc.

Blog Article

Kam Financial & Realty, Inc. Fundamentals Explained

Table of ContentsThe Single Strategy To Use For Kam Financial & Realty, Inc.Fascination About Kam Financial & Realty, Inc.Facts About Kam Financial & Realty, Inc. RevealedThe Greatest Guide To Kam Financial & Realty, Inc.About Kam Financial & Realty, Inc.Some Known Details About Kam Financial & Realty, Inc. The 8-Minute Rule for Kam Financial & Realty, Inc.

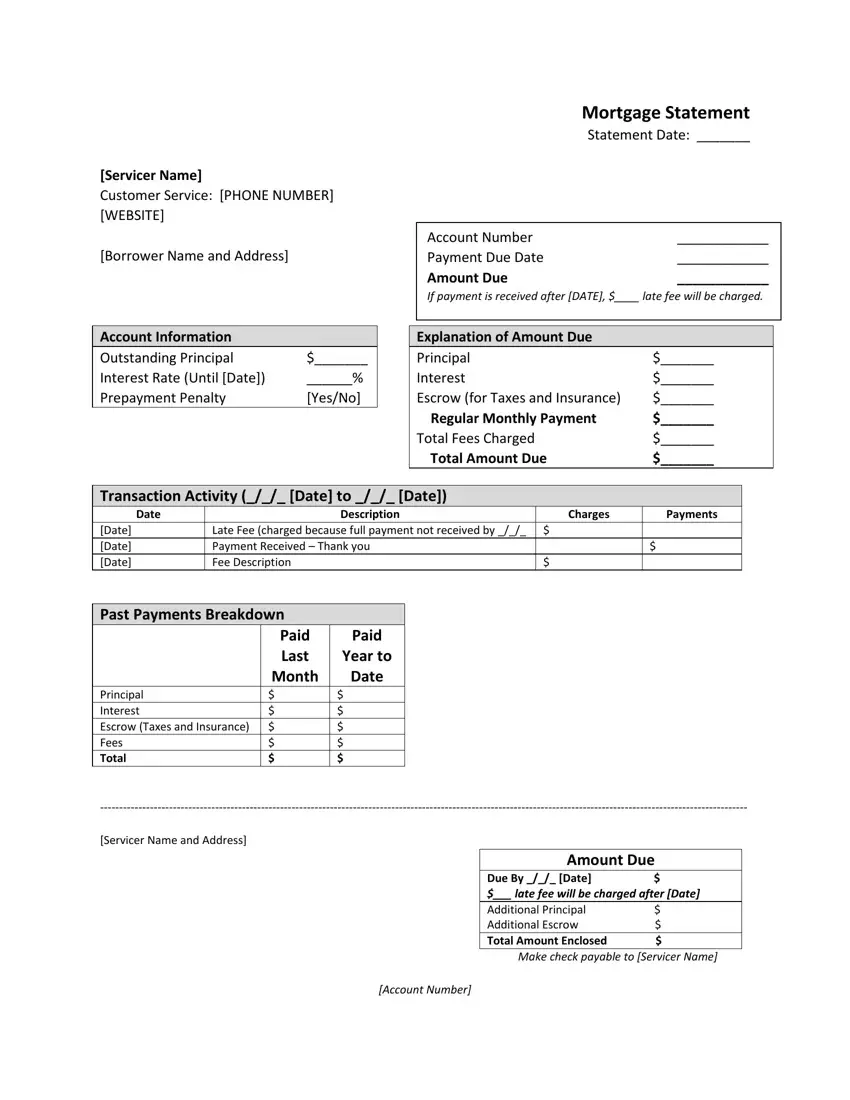

The home getting procedure involves numerous steps and variables, implying each person's experience will be special to their family, financial situation, and desired building. That does not mean we can't help make feeling of the home mortgage procedure.A is a type of finance you utilize to get property, such as a home. Generally, a lender will certainly offer you a set amount of money based on the worth of the home you want to purchase or own.

Some Known Facts About Kam Financial & Realty, Inc..

To qualify for a home loan, you will require to be a minimum of 18 years old. Factors that assist in the mortgage procedure are a reputable income resource, a solid credit rating, and a moderate debt-to-income proportion. https://zenwriting.net/kamfnnclr1ty/why-partnering-with-a-mortgage-loan-officer-in-california-makes-sense. You'll find out extra concerning these consider Component 2: A is when the homeowner gets a new mortgage to replace the one they currently have in place

A functions in a similar way to an initial home loan. You can borrow a set amount of cash based on your home's equity, and pay it off via taken care of regular monthly repayments over a set term. A runs a bit in a different way from a standard home loan and is comparable to a charge card. With a HELOC, you receive authorization for a fixed quantity of money and have the adaptability to obtain what you need as you need it.

This co-signer will certainly concur to pay on the home mortgage if the customer does not pay as concurred. Title firms play a crucial function making certain the smooth transfer of residential property ownership. They look into state and region documents to confirm the "title", or possession of your house being purchased, is complimentary and free from any other home mortgages or commitments.

The Greatest Guide To Kam Financial & Realty, Inc.

In addition, they give written guarantee to the lending organization and produce all the documents needed for the mortgage loan. A down settlement is the quantity of cash money you have to pay ahead of time towards the purchase of your home. If you are buying a home for $100,000 the lending institution may ask you for a down payment of 5%, which means you would be called for to have $5,000 in cash money as the down settlement to get the home. https://spiny-meadow-b9c.notion.site/How-a-Mortgage-Loan-Officer-in-California-Can-Transform-Your-Home-Buying-Experience-4382862130ce4db78044cc4df7b835c9.

The principal is the quantity of cash you get from the lending institution to buy the home. In the above example, $95,000 would be the amount of principal. A lot of lending institutions have traditional home mortgage standards that permit you to obtain a certain percentage of the value of the home. The portion of principal you can borrow will differ based on the home loan program you qualify for.

There are special programs for first-time home buyers, experts, and low-income borrowers that allow reduced down repayments and higher percents of principal. A home mortgage lender can review these options with you to see if you qualify at the time of application. Interest is what the lending institution fees you to borrow the cash to get the home.

What Does Kam Financial & Realty, Inc. Do?

If you were to secure a 30-year (360 months) home loan and obtain that very visite site same $95,000 from the above instance, the complete quantity of interest you would pay, if you made all 360 regular monthly settlements, would be a little over $32,000. Your regular monthly payment for this lending would certainly be $632.

When you have a home or property you will have to pay real estate tax to the region where the home lies. Most lending institutions will certainly need you to pay your taxes with your home mortgage payment. Real estate tax on a $100,000 loan can be about $1,000 a year. The lending institution will divide the $1,000 by 12 months and include it to your payment.

Kam Financial & Realty, Inc. Can Be Fun For Everyone

Once again, since the home is seen as collateral by the lending institution, they desire to make certain it's secured. Like tax obligations, the lending institution will also offeror often requireyou to include your insurance premium in your regular monthly payment.

Your payment now would enhance by $100 to a brand-new total amount of $815.33$600 in concept, $32 in rate of interest, $83.33 in tax obligations, and $100 in insurance. The lending institution holds this cash in the very same escrow account as your real estate tax and pays to the insurer in your place. Closing costs refer to the expenditures connected with processing your finance.

Not known Factual Statements About Kam Financial & Realty, Inc.

This ensures you recognize the overall expense and accept proceed before the funding is moneyed. There are several various programs and lending institutions you can pick from when you're purchasing a home and getting a mortgage that can assist you navigate what programs or alternatives will certainly function best for you.

Get This Report about Kam Financial & Realty, Inc.

Lots of financial establishments and realty agents can help you recognize just how much cash you can spend on a home and what financing quantity you will certainly qualify for. Do some study, but likewise request for referrals from your close friends and household. Locating the best companions that are a great fit for you can make all the distinction.

Report this page